Overview of Gold Rates in Pakistan

Gold has long been regarded as a significant asset within Pakistani culture, serving not only as a valuable investment but also as a traditional gift during major life events such as weddings and religious ceremonies. The gold rate in Pakistan today is shaped by various factors that blend local and global economic trends. One of the primary factors is the fluctuation in international gold prices, which are determined by various elements, including inflation rates, currency strength, and geopolitical tensions. Thus, the prices of gold in Pakistan, including the 24k gold rate in Pakistan and 22k gold rate in Pakistan, are often swayed by these global market dynamics.

Additionally, the exchange rate of the Pakistani rupee against the US dollar plays a pivotal role in determining local gold prices. An appreciation of the dollar could lead to an increased today gold rate in Pakistan, making gold more expensive for local investors. Conversely, if the rupee strengthens, it can result in a decrease in gold prices, prompting more investments from the public.Historical trends show that fluctuations in gold rates can directly affect a country’s economic stability, as people often turn to gold during periods of economic uncertainty, considering it a reliable safe-haven asset.

Market demand and supply also fundamentally influence prices. When demand for gold spikes, it naturally drives prices up, while a surplus might cause prices to dip. This interplay among various factors means that the gold price pack can vary significantly from one day to the next. Consequently, staying informed about the today gold rate in Pakistan 2024 is crucial for investors looking to capitalize on market opportunities or hedge against economic risks.

Today’s Gold Rate Per Tola – December 10, 2024

As of December 10, 2024, the gold rate in Pakistan exhibits notable figures, reflecting both the national and global market dynamics. The current rate for 24K gold per tola is reported at PKR 248,000, a rate that marks a significant increase from last week when it was priced at PKR 242,000. This surge can be attributed to heightened demand driven by festive season purchases and geopolitical tensions which tend to drive investors towards gold as a safe haven.

In addition to the increase in the 24K gold rate, the 22K gold rate in Pakistan stands at PKR 227,000 per tola, a noticeable fluctuation compared to the previous month’s average of PKR 221,000. Market analysts suggest that these changes are tied closely to both local economic conditions and international trends in gold prices. The worldwide gold market has been impacted by inflationary fears and changes in interest rates, factors that have historically influenced gold prices across the board.

The rise in today gold rate in Pakistan has not gone unnoticed by the general public and investors alike, as many seek to capitalize on the current market conditions. Gold, especially 24K, has consistently been viewed as a reliable investment. As such, gatherings and events around gold purchases have seen a marked increase. Similarly, the demand for 22K gold, often preferred for jewelry making, has also been on the rise. Observing the trends from the past week, it is evident that fluctuations in the gold market are becoming more pronounced, indicating a potential for further changes in the upcoming days.

Keeping track of the gold rate in Pakistan today is essential for anyone engaged in gold transactions, be it for investment purposes or personal use. As the economy continues to evolve, staying informed about current rates will be essential for making sound financial decisions regarding gold purchases.

Factors Influencing Gold Prices Today

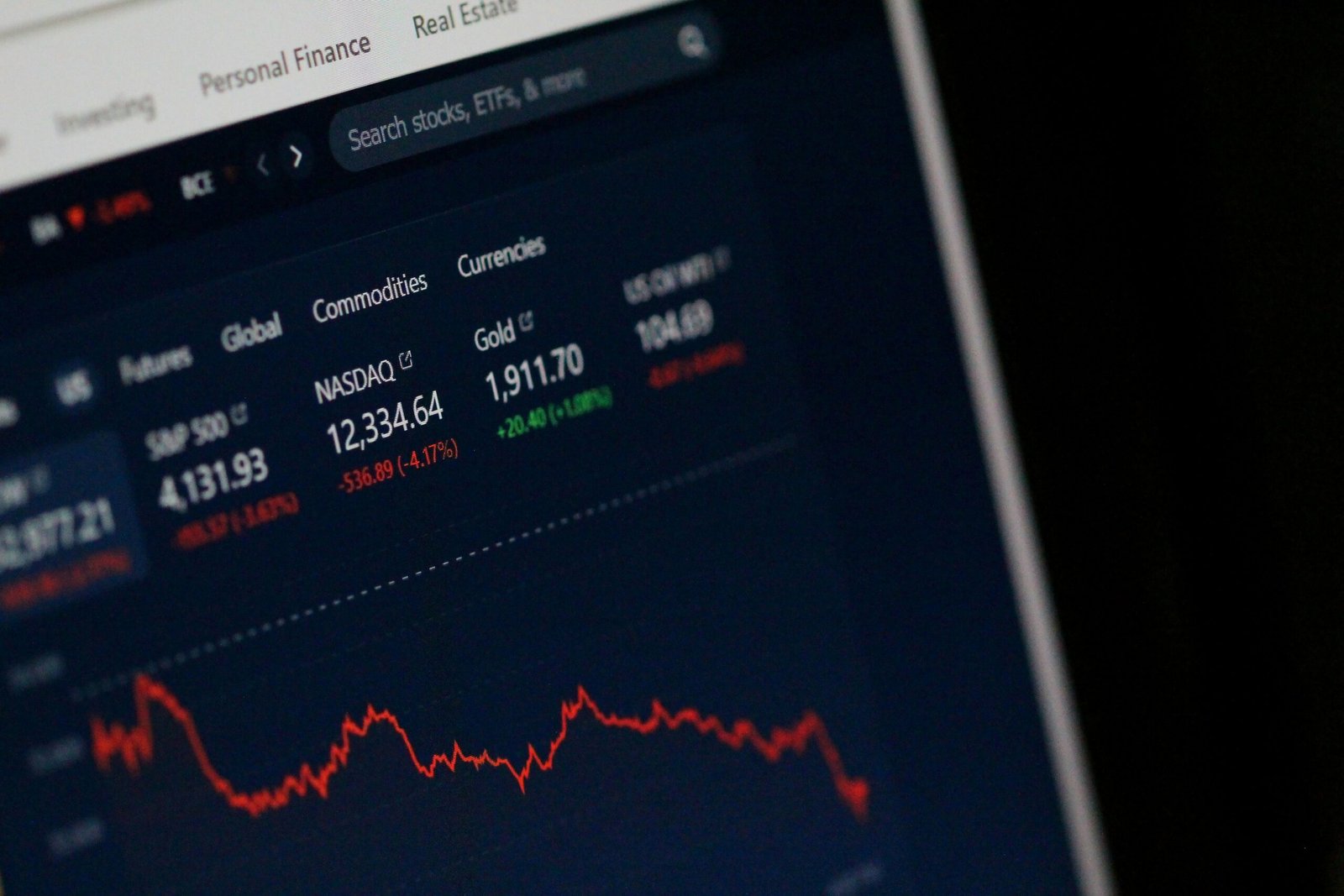

The gold market is complex and its pricing reflects a myriad of variables that can significantly impact the today gold rate in Pakistan.A key influencer is the international gold price, which is largely determined by trading activity in major markets like New York and London.

When global demand rises due to economic uncertainty or increased investment by major financial institutions, the price of gold tends to increase, which can directly affect the gold price pak in local markets. Investors often keep an eye on these trends to make well-informed decisions about the timing of buying or selling.

Moreover, variations in currency values, especially the US dollar, significantly influence gold pricing. In Pakistan, as the value of the Rupee declines against the dollar, the today gold rati in Pakistan generally increases. This is because gold is typically priced in dollars; thus, any depreciation of the local currency leads to higher prices when converted to Rupees.

Local demand and supply are also pivotal factors affecting the gold rate in Pakistan. In festive seasons or events like weddings, the demand for gold tends to surge, pushing prices higher. Conversely, when the market is saturated with gold, the price may stabilize or decline. Analysts often keep an eye on these seasonal trends to gauge potential movements in the market.

Finally, geopolitical events can cause fluctuations in gold prices. For instance, political instability or conflicts can lead to increased investor interest in gold as a “safe haven” asset, thereby affecting the today gold rate in Pakistan 24k per tola. By understanding these variables, consumers and investors can better navigate the complexities of gold purchasing, be it for investment or personal use.

Investment Insights and Future Predictions

Gold has traditionally been viewed as a safe-haven asset, particularly during periods of economic uncertainty. As of December 10, 2024, the today gold rate in Pakistan has shown various fluctuations influenced by both domestic and global market trends. Investors are keen to understand whether the current rates, including the 24k gold rate in Pakistan today, present a favorable opportunity for investment or divestment. Analyzing the economic landscape, including inflation rates, currency stability, and geopolitical developments, can provide valuable insights into future gold price trends